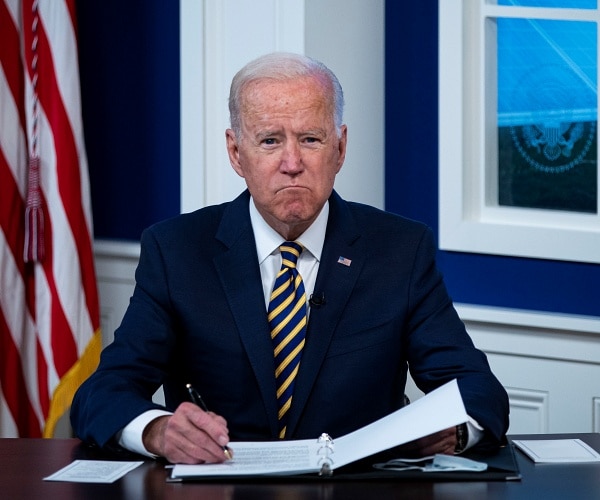

President Joe Biden has repeatedly called on Americans to “pay their fair share” as he seeks to dramatically increase taxes to pay for the $1.2 trillion infrastructure and $3.5 trillion budget reconciliation bills, but Rep. Jim Banks, R-Ind., laments Biden “wants to raise your taxes, but doesn’t even pay his own.”

Banks tweeted:

“Unbelievable!! I asked the nonpartisan Congressional Research Service for a report on multimillionaire Joe Biden’s use of corporate loopholes to avoid paying taxes…

“Turns out he wants to raise your taxes, but doesn’t even pay his own!”

Banks, the Republican Study Committee chairman, was responding to the New York Post’s report on the findings of the nonpartisan CRS showing how Biden — without being mentioned by name — avoided paying Medicare tax on speaking fees and book sales in 2017 and 2018, improperly using “S corporations” to show low salaries but count most revenue as “distributions” exempt from Medicare tax.

“Joe Biden wants to raise taxes by $2.1 trillion while claiming the rich need to pay their ‘fair share,'” Banks told the Post. “But in 2017, multi-millionaire Joe Biden skirted his payroll taxes — the very taxes that fund Medicare and Obamacare.

“According to the criteria CRS provided to my office, he owes the IRS and the American people hundreds of thousands of dollars in back taxes. Every American should know about Joe Biden’s tax hypocrisy.”

The shortage reported comes from Biden and first lady Jill Biden routing more than $13 million through S corporations in 2017 and ’18, but only claiming less than $800,000 of it as salary eligible for the Medicare tax at a mere 3.8% rate, according to The Wall Street Journal in 2019.

That Journal report noted the $500,000 savings in tax payments, but Banks has been inclined to remind Americans of the hypocrisy amid the Biden’s push to raise taxes that he has found a way to not pay himself.

Former President Donald Trump has long rebuked the American inequity of the U.S. tax loopholes that only the rich can avoid to hire tax experts to get around paying “their fair share.” For that reason, Trump said his tax reform sought to simplify the tax code.

“Joe Biden wants to expand the IRS’s funding and authority, so they can audit more Americans,” GOP veteran Chris Jabobs told the Post. “Given that the liberal Tax Policy Center and the non-partisan Congressional Research Service both have raised questions about the way Biden handled his taxes, why doesn’t he ask for his own taxes to get audited first?

“Biden doesn’t really believe in expanding programs like Medicare and Obamacare, because he thought buying a second multi-million dollar mansion, and renting a third, was more important than helping to fund those laws.”

You can read the full report on the CRS report cited by Banks below:

Updated Memorandum – IRS Au… by stevennelson10