Democrats on the House Ways and Means Committee are trying to wrap up their proposal for $2.9 trillion in tax hikes, which would mean the largest tax increase in decades, in order to help pay for higher spending in their ‘reconciliation’ package, Politico reported on Monday.

The Wall Street Journal reported that the proposal is expected to include raising the corporate tax rate to 26.5% from 21% and enacting a 3-percentage-point surtax on individual income above $5 million.

House Democrats are also thinking about boosting the minimum tax on the foregn income of U.S. companies to 16.5% from 10.5%, as well as raising the top capital-gains tax rate to 28.8% from 23.8%.

The significance of the proposals is that House Democrats have until now been vague about their plans to boost taxes as they try not to anger either moderates in the party concerned about the economic impact of increasing taxes or progressives who seek to raise taxes on the rich in order to expand the social safety net.

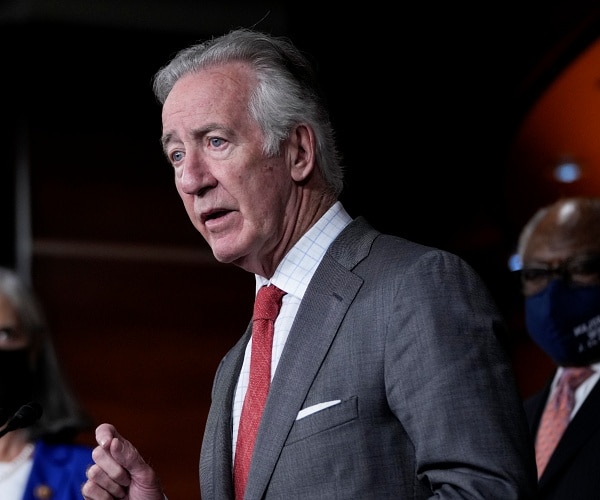

Committee Chairman Richard Neal has said that providing details for the planned increase in taxes too soon could give too much time for opposition to the proposals to grow.

The proposals, set to be formally unveiled sometime this week, would be a major step forward for Democrats as they attempt to work out their plans for what would likely be the most consequential legislation of the Biden administration.

Other details in a five-page memo being passed around about the Democrats’ plans include tightening estate tax rules and reducing deductions for some unincorporated businesses, as well as new limits on supersized individual retirement accounts, additional restrictions on deductions companies take for highly compensated employees, and new “wash sale” rules for those who own cryptocurrencies.

The Wall Street Journal pointed out that the monetary value of the tax increases “includes $1 trillion in tax increases on individuals, $900 billion on corporations, $700 billion from drug-pricing policy changes, and $120 billion from tougher tax enforcement. Adding miscellaneous other changes and an assumption that the economy will grow reaches $3.5 trillion.”

White House spokesman Andrew Bates praised Neal’s proposals, saying that “this meets two core goals that the president laid out at the beginning of this process — it does not raise taxes on Americans earning under $400,000 and it repeals the core elements of the Trump tax giveaways for the wealthy and corporations.”

Bates added that “the President looks forward to continuing to work with Chairman Neal, as well as the Senate Finance Committee and Chairman Wyden, as we advance the Build Back Better agenda.”